Table of contents

Signing a mortgage application or loan agreement online is now a standard part of the home buying experience.

Traditionally, a mortgage application or loan agreement used to mean printing, scanning, and mailing stacks of paperwork. This can often delaying closings by several business days.

But with document management and electronic signature tools like Xodo Sign, you can complete your loan application in a reasonable time, without the paperwork hassle.

It means less waiting, fewer errors, and a smoother experience for everyone involved.

Steps to sign your mortgage application or loan agreement with Xodo Sign

Follow these steps to sign your mortgage application or loan agreement with Xodo Sign.

1. Sign up or log in to Xodo Sign

- If you're new to Xodo sign, click on the Sign Up button and create a new account.

- If you already have an account, log into your account.

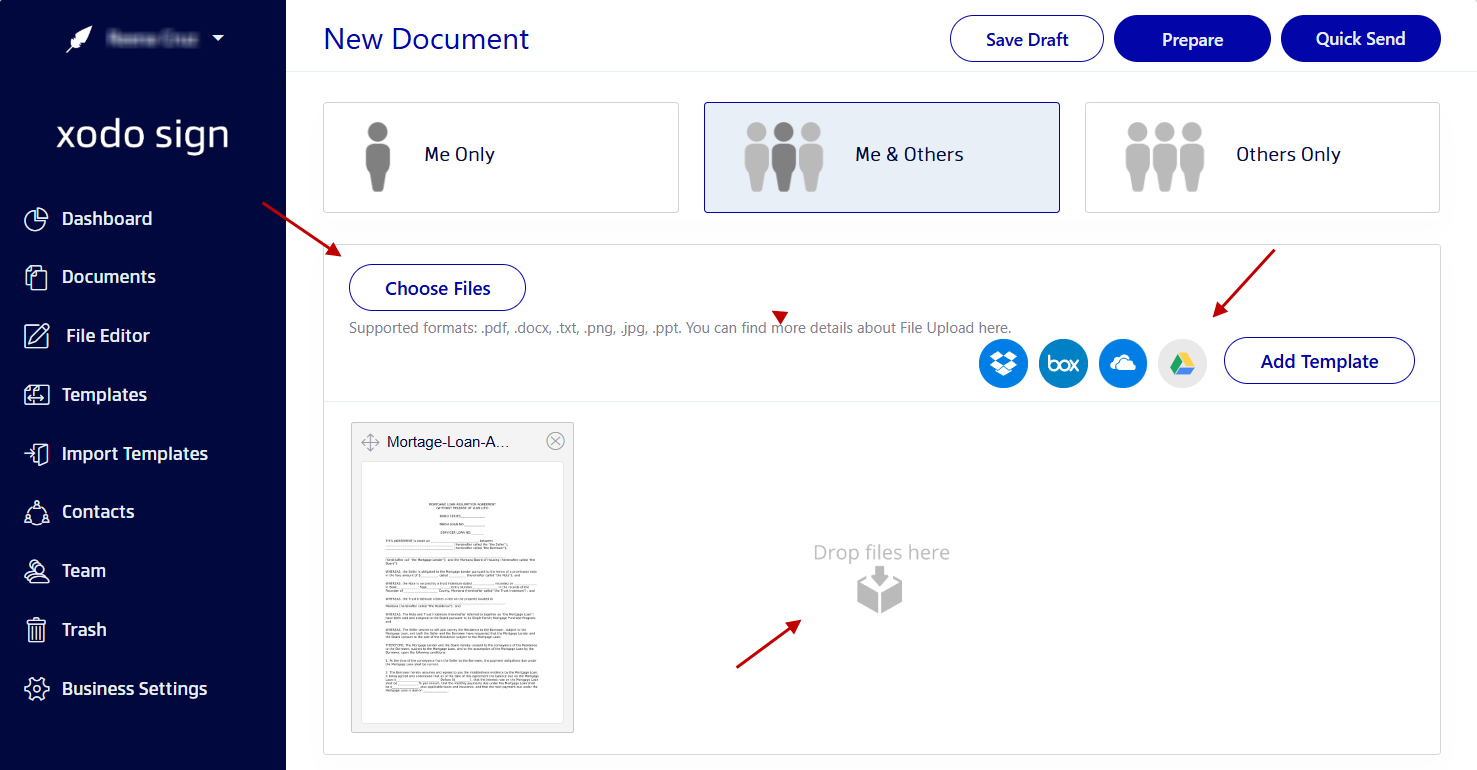

2. Upload your mortgage or loan document

- In the Documents tab, click on the + icon.

- Click on Choose Files.

- Browse for, select, upload your PDF or Word file.

- You can also drag and drop your document into the file upload area or upload it from your cloud storage account.

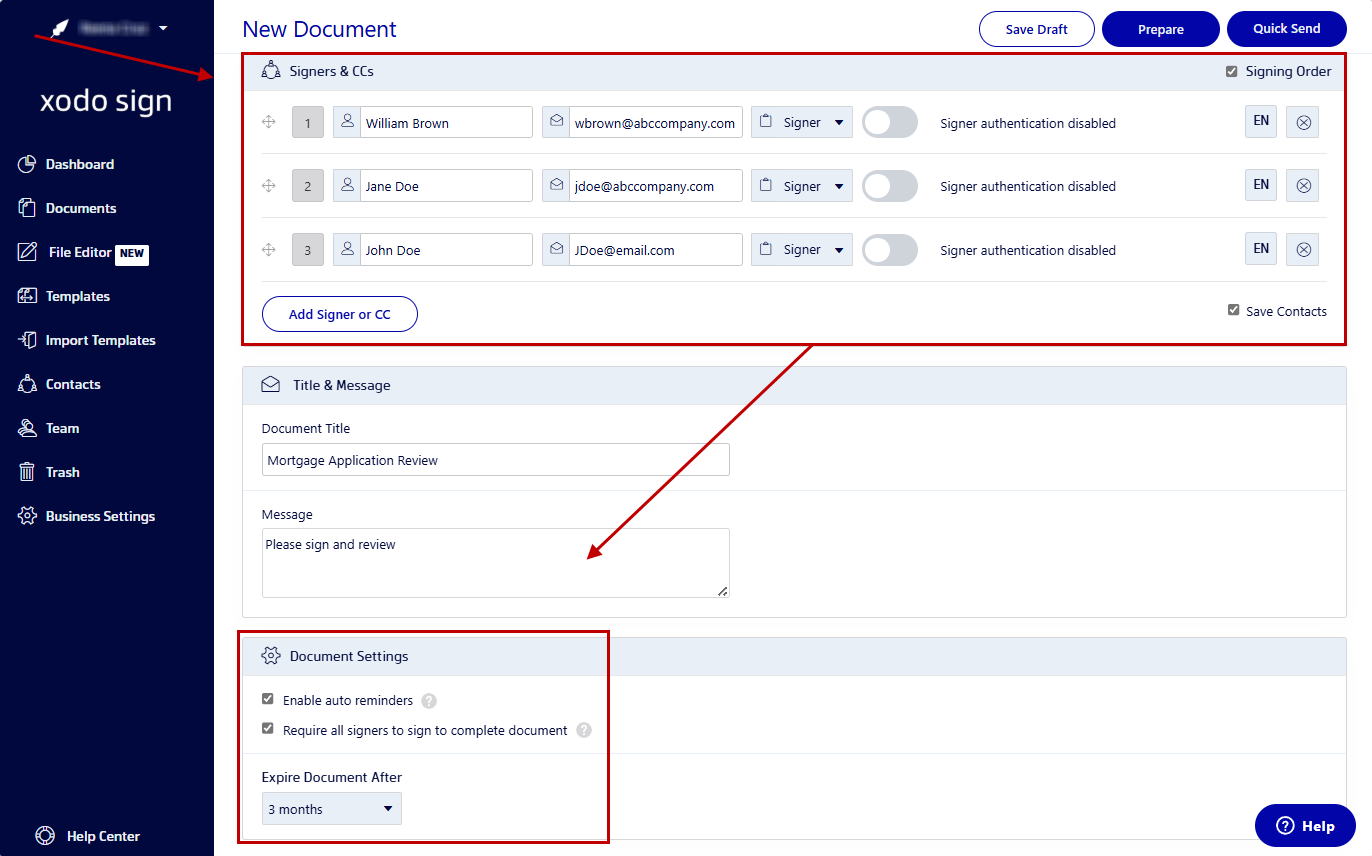

3. Add and request signatures from multiple signers

- Add and request signatures from multiple signers

- Select from the signer options provided: Just You, You and Others, or Others Only.

- Add the names and emails for each signer.

- Assign each signer a role as Signer or CC.

- Set a signing order if needed.

- For added security, turn on authentication via SMS or PIN individual signers.

- Write a message with a subject line.

- Adjust your document settings. You can turn on reminders, require all fields to be filled, and set an expiration date.

- Click on Prepare to continue.

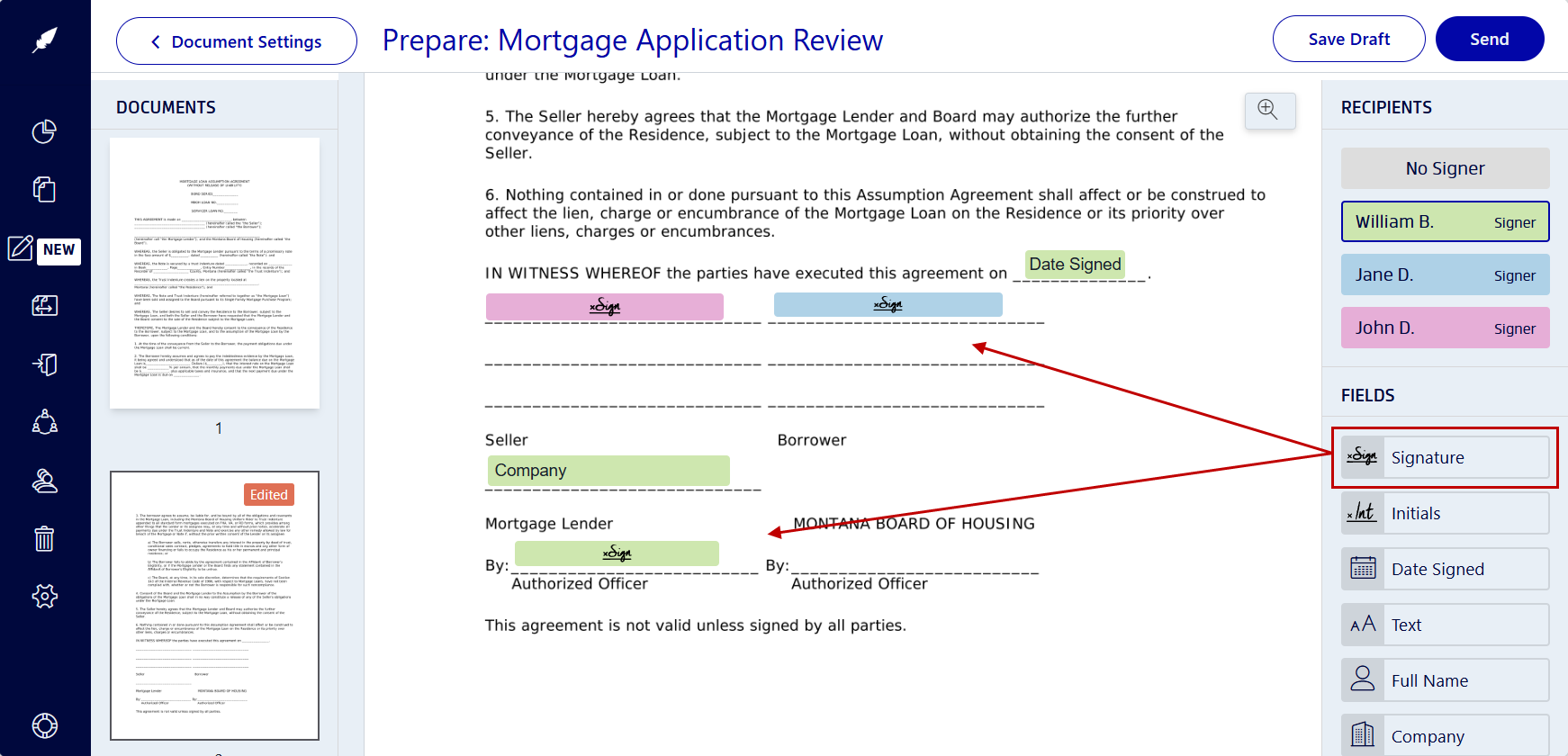

4. Insert your signature and add form fields

- Drag any signing fields (Signature, initials, date, full name) onto your document where needed.

- Assign fields to the other signers and yourself.

- In your own signature field, draw, type, or upload an image of your signature. You can also use a saved signature if you have one stored in Xodo Sign.

- Click on Sign.

- Tip: Use Text fields for adding in details like the property address or loan amounts to complete the application accurately and in full.

5. Send and track for signatures

- Click on Send.

- Track your document's progress and see who’s signed and who’s pending from your Documents dashboard.

Xodo Sign features that simplify signing of real estate documents

Xodo Sign is built for secure, and efficient real estate document workflows with features like:

- Audit trails

Every action is logged for full transparency. - In-app PDF editing

Redact, comment, or update text without switching tools. - AI summarizer

Quickly review key loan terms before signing. - Multi-signer support

Add multiple signers in any order. - Mobile-friendly

Manage forms from iOS or Android devices. - Bank-level security

256-bit encryption and SOC 2 compliance.

By combining robust document editing with legally binding e-signatures, Xodo Sign keeps your mortgage process under one roof.

Want to try Xodo Sign's advanced features? Start a free trial today. You can cancel anytime, no cc required.

The benefits of signing a mortgage or loan documents online

Moving your mortgage application or loan agreement online saves time and cuts errors. If you're a borrower, loan officer, lender, or real estate broker, online signing offers clear benefits:

- Save time and reduce errors

Send and receive signed documents in minutes, not days. Built-in validation to make fields required ensures that details, like loan amount, interest rate, and monthly payments, are completed and filled in.

- Improve accuracy and compliance

Missing signatures, dates, or fields can delay approval. Xodo Sign uses required fields and audit trails to help meet federal government and lender requirements.

- Convenience for all parties

Lenders can review bank account statements, pay stubs, or tax returns remotely. Brokers can track progress and send updates instantly across devices.

Tip: If you need to sign other real estate forms and documents, check out our guides on:

What to review before you sign your loan agreement

Signing a loan agreement online is legally binding, so be sure you understand what you're agreeing to.

Here’s a starting list of what you should review before signing:

- Loan amount and interest rate.

- Monthly payments and payment schedule.

- Mortgage insurance requirements.

- Closing costs, fees, and any prepayment penalties.

- Security interest details (what the lender can claim if you default).

- Your legal right to cancel or dispute terms.

- Whether the agreement includes all parties involved (ie., co-borrowers).

- Any notice periods or conditions tied to approval.

- Accuracy of your income, property, and documentation details.

Tip: Use Xodo Sign’s built-in AI Summarizer tool to highlight key terms of the agreement before signing.

Frequently asked questions

Find answers below common questions about signing mortgage applications and loan agreements online with Xodo Sign.

Are e-signatures legally binding for loan agreements?

Yes. E-signatures added with Xodo Sign meet ESIGN and UETA standards, making them enforceable for real estate loans.

Can I request a signature on a mortgage application from my phone?

Yes. Xodo Sign mobile features let you request a signature on iOS and Android devices. You can sign, and send loan agreement documents from your smartphone or tablet.

How do I add a co-borrower to my loan document?

When uploading your document to Xodo Sign, click on Add under the Signer section and enter the co-borrower’s name and email. Then click on Prepare and add signature boxes or initials assigned specifically to them.

What file formats does Xodo Sign accept?

You can upload PDF, Word, and image files to Xodo Sign. Note that non-PDF files convert automatically to PDFs you can edit and sign.

Can I edit a loan agreement after someone signs?

Once the document is signed, you will need to create a new copy to edit it. You will then need to resend the edited copy for signing.

Start signing loan agreements smarter

Signing mortgage application or loan agreements is easy with Xodo Sign. With advanced electronic signatures, you can complete key steps in the mortgage process, like reviewing a loan estimate or finalizing a promissory note, directly in your web browser.

Xodo Sign makes it easy to upload your mortgage loan documents, place signature fields, and securely request signatures from others.

Ready to save time and simplify your first closing? Sign up for Xodo Sign today.